WHY BOYCOTT

CITIZENS BANK?

A HISTORY OF COMPLICITY

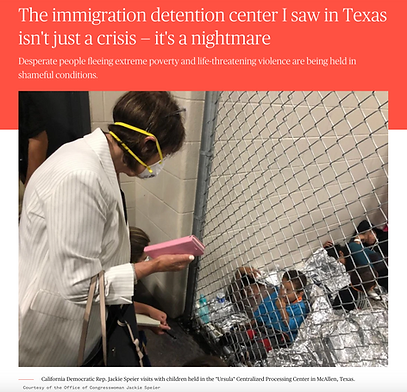

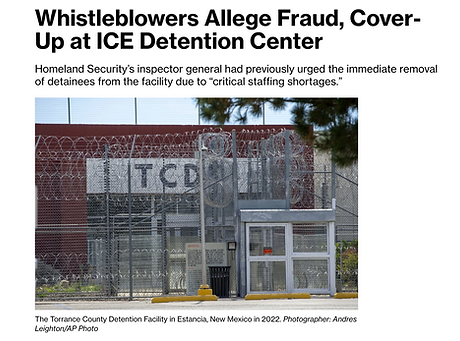

Through subsidiaries including Citizens Bank, Citizens Financial Group (CFG) has been a major lender to private prison and detention operators for years despite a mountain of allegations against them including abuse, fraud, hazardous working conditions, sexual harassment, medical neglect, and forced labor.

Citizens of Pennsylvania continues its relationship with the Corrections Corporation of America in an amendment to their 2012 agreement.

Citizens Capital Markets, Inc. underwrites an undisclosed portion of $250 million of bonds CoreCivic issued.

Responding to public outcry around the first Trump administration's immigration policies, lenders begin to cut ties with CoreCivic and GEO Group.

In total, nine lenders pledge to end their relationships: JPMorgan Chase, Wells Fargo, Bank of America, SunTrust, BNP Paribas, Fifth Third Bancorp, Barclays, U.S. Bancorp, and PNC.

Citizens Bank strengthens its ties to the industry instead.

CoreCivic signs a credit agreement to replace their 2018 credit facility. Unlike in previous agreements, public disclosures do not name lenders; they only name the administrative agent, Alter Domus.

CoreCivic and GEO's fraud, corruption, and abuse continue.

Will Citizens continue to finance them?

Citizens Financial Group starts its relationship with CoreCivic, then the Corrections Corporation of America, as its subsidiary Citizens of Pennsylvania commits $65 million of a $900 million loan.

With second and third amendments to their 2012 agreement, Citizens of Pennsylvania continues its relationship with the Corrections Corporation of America.

2018

As part of a $1 billion credit agreement involving ten lenders, Citizens Bank deepens its involvement with CoreCivic by providing up to $120 million of credit.

Citizens Bank replaces Bank of America in the role of administrative agent for their 2018 agreement. Citizens now acts as an intermediary between CoreCivic and the lenders in the agreement.

Citizens Bank becomes a lender to The GEO Group, playing a key role $700+ million credit agreement and a $1.275 billion registration rights agreement.

CoreCivic issues $500 million in bonds, with Citizens JMP Securities underwriting $200 million.

2025

2012

2013

2014

2015

2016

2017

2019

2020

2021

2022

2023

2024

OTHER BANKS WITH PRIVATE PRISON TIES

While Citizens has served as a key lender to CoreCivic, and more recently The GEO Group, it is not the only bank enabling their expansion. The banks below have all named in financial agreements inked in recent years:

-

Alter Domus

-

TCBI Securities, Inc. (Texas Capital Bank)

-

Regions Financial Corp. (Regions Bank)

-

FHN Financial (First Horizon Bank)

-

Synovus Securities, Inc.

-

StoneX Financial

-

Wedbush Securities

-

Cantor Fitzgerald

-

Compass Point Research & Trading

-

Imperial Capital

-

JonesTrading Institutional Services

-

Noble Capital Markets

-

Northland Securities

-

Virtu Americas LLC

-

Ankura Trust

If you do business with these banks and want to find a better option, this guide can help.